Scope 3 Emissions: Different Industries, Different Needs.

01 September, 2023

Apples and Oranges don’t go in the same basket.

In this blog, we will explore some of the industry-specific differentiators and challenges organizations face in managing Scope 3 data and discuss potential solutions to address them effectively.

Let’s start with the ABCs.

Scope 3 Emissions and GHG Protocol:

Scope 3 emissions are indirect greenhouse gas emissions that occur in an organization's value chain but are not directly owned or controlled by the organization.

They can include emissions from the transportation of goods by vehicles not owned by the organization, the use of sold products, and waste disposal, among others.

Comparing agricultural produce emissions to cement emissions is like comparing Apples to Oranges. Both of the products have different production and supply chain processes. Every industry is different and has nuances that significantly affect its Scope 3 emission’s contribution to the total emissions.

ESG initiatives have gained significant momentum in recent years, encouraging companies and their supply chains to focus on responsible sourcing. One of the primary challenges faced in supply chain sustainability is the generalization of the Scope 3 emission standards and calculations.

The Greenhouse Gas Protocol (GHG Protocol), a global standard for measuring and reporting greenhouse gas emissions, defines 15 categories of Scope 3 emissions. These categories include different business activities such as purchased goods and services, upstream transport, waste, business travel, upstream/downstream leased assets, processing of sold products, capital goods, and investments.

The Important and The Irrelevant

While the GHG Protocol provides an extensive list of Scope 3 contributors, all categories are not relevant to all industries. Every industry has its distinct environmental footprint due to its mode of operations, sourcing, and distribution,

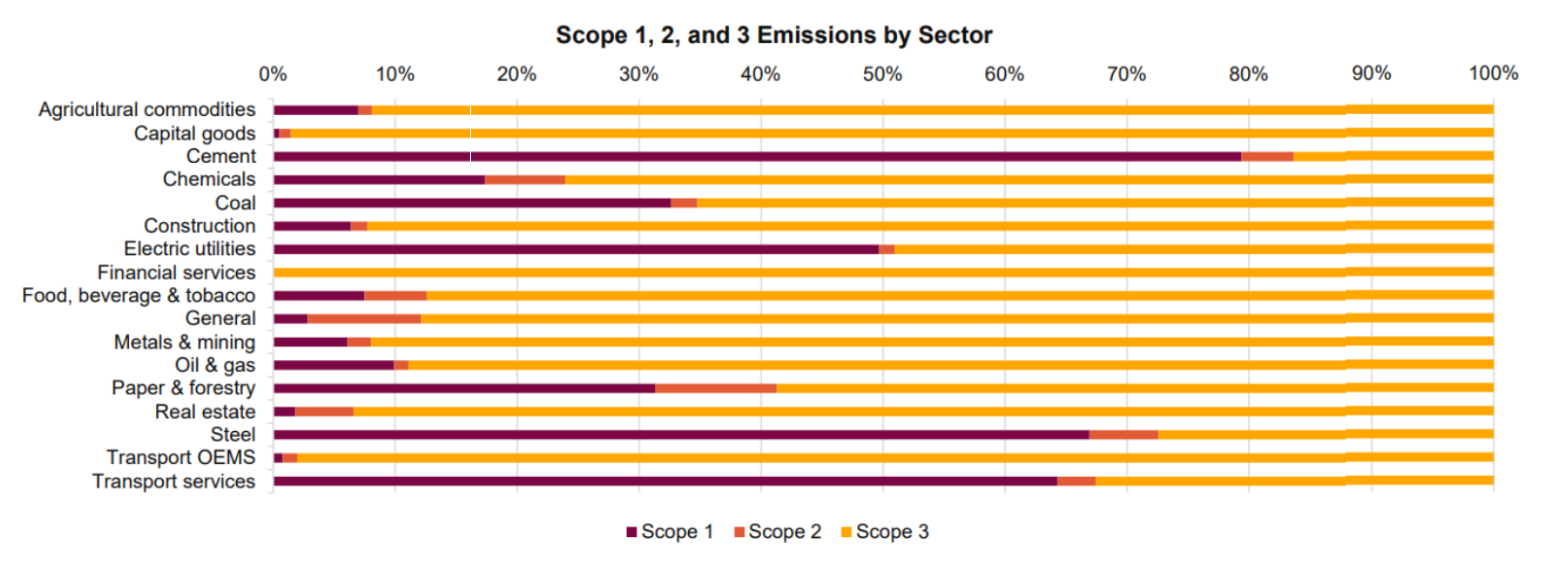

which makes generalized standards irrelevant in many instances. The chart from a CDP report provides an overview of how the share of Scope 1, 2, and 3 emissions differs for different industries.

While for the Capital Goods industry, Scope 3 constitutes almost all of its total emissions, for the Cement industry, it’s Scope 1 emissions that they worry about the most. Let’s have a closer look at the industry-wise top Scope 3 contributors.

Different Sources of Emissions

Here are a few examples of how industries differ in their Scope 3 emission categories:

Agriculture: Food processing, packaging, storage, and cooking are critical sources of post-production emissions for the Agricultural Commodities sector. Therefore, Scope 3 Category 10, “Processing of sold products,” and Category 11, “Use of sold products,” are the most relevant categories for this industry

Construction: Building developers need to primarily measure and report Scope 3 Category 2 “Capital Goods” to account for the embodied emissions of new buildings (e.g., construction materials such as steel and concrete) and Scope 3 Category 11 “Use of sold products” to account for the expected operational emissions from any buildings sold. Scope 3 Category 12, “End of life treatment of sold products”, is also relevant for building developers to account for end-of-life emissions for any buildings sold

Financial Services: The Financial Services sector’s largest source of emissions comes from its lending, investment, and insurance underwriting activities, i.e., portfolio emissions, accounted under Scope 3 Category 15, “Investments”

Food, Beverage, & Tobacco: Companies in this industry should primarily measure and report Scope 3 Category 1 “Purchased goods and services”. They could also consider Scope 3, Category 4, “Upstream Transportation and Distribution”, and Category 9, “Downstream Transportation and Distribution,” relevant to account for transport-related emissions within their supply and distribution chains

The call for industry-specific emission standards has been going on for a long time, and the differences in emission source profiles make a strong case. Custom standards and templates will allow industries to concentrate on categories most relevant to them, enabling them to align their efforts to their ESG goals specifically from their supply chain.

Is It Worth It?

Then, the question begs, given the complexity and difficulty of managing and reporting scope 3 emissions, is it worth putting in the extra effort?

Absolutely, yes!

As we have seen from the CDP chart, in most industries more than 50% and in some cases as high as 80+% of the total emissions come from the supply chain. Reporting Scope 3 emissions is a valuable tool for companies committed to sustainability and with clearly stated goals including turning net zero. Increasingly, it is becoming a compliance issue that can be turned into a competitive advantage.

Challenges and Solutions

The challenges of managing Scope 3 data can vary depending on the industry. Some of the key challenges at the supply chain level include:

-

Data availability: Consolidating Scope 3 emissions data can be difficult, especially for small and medium-sized suppliers

-

Data accuracy: The accuracy of Scope 3 emissions data can be questionable, as it is often calculated using assumptions and estimates

-

Data complexity: The complexity of data on Scope 3 emissions can be challenging to manage, as it can involve multiple sources and stakeholders

-

Data cost: The cost of collecting and managing data on Scope 3 emissions can be high, especially for small and medium-sized enterprises attempting to do it manually with their own subject matter experts

Then how can companies streamline their Scope 3 emissions management? This is where Treeni comes in.

Our resustain™ SMB is a SaaS-based ESG reporting platform that large global enterprises in any industry can effortlessly deploy to all their suppliers. The platform offers ready-to-use data management templates, numerous emissions libraries, dashboards, and standard reporting templates for suppliers. The platform is delivered as part of a managed services solution, this includes a Treeni team that will engage directly with SMB suppliers to help them through the entire process, allowing suppliers to understand and improve their ESG performance while aligning with their key customers’ goals & targets.

Conclusion

Scope III data presents challenges and opportunities for industries striving to achieve comprehensive ESG compliance. By recognizing the industry-specific nature of these challenges, organizations can better tailor their sustainability strategies and collaborate with stakeholders to drive positive change. Embracing technology, fostering partnerships, and customizing ESG reporting practices will pave the way for a more sustainable and responsible future across various industries. As we continue this journey toward collective compliance, the path to sustainable growth becomes more transparent for all stakeholders.

__________________________________________________________________________________________________________________________________________________