Understanding E, S and G in the ESG story

20 April, 2022

ESG as a concept is still evolving, hence understanding of ESG, i.e., Environment, Social, and Governance, is yet to occur. However, undoubtedly the past year has been disruptive and concerns around climate change and the environment have united us in more ways than one. COP26 was one such event that helped people to come together and protest about climate while putting the environment and sustainability on center stage. This in turn has led businesses to act with immediate actions; yet, there is a need for more action to be taken for major societal and global change. A growing number of listed conglomerates are incorporating ESG strategy within their annual report to track and illustrate corporate progress on key issues. We must still acknowledge the fact that it is no longer about the results of the bottom line. For the change to be more realistic, there needs to be a deeper understanding of the Environment, Social, and Governance. Businesses need to embrace ESG as a corporate initiative rather than just a box-ticking exercise.

“When sustainability is viewed as being a matter of survival for your business, I believe you can create massive change.” — Cameron Sinclair, Architect and CEO of the Worldchanging Institute.

The above quote strongly emphasizes the need for businesses to give more importance to people, planet and prosperity. Also, the financial performance of ESG stocks has recently drawn investor attention.

So, what does ESG stand for?

-

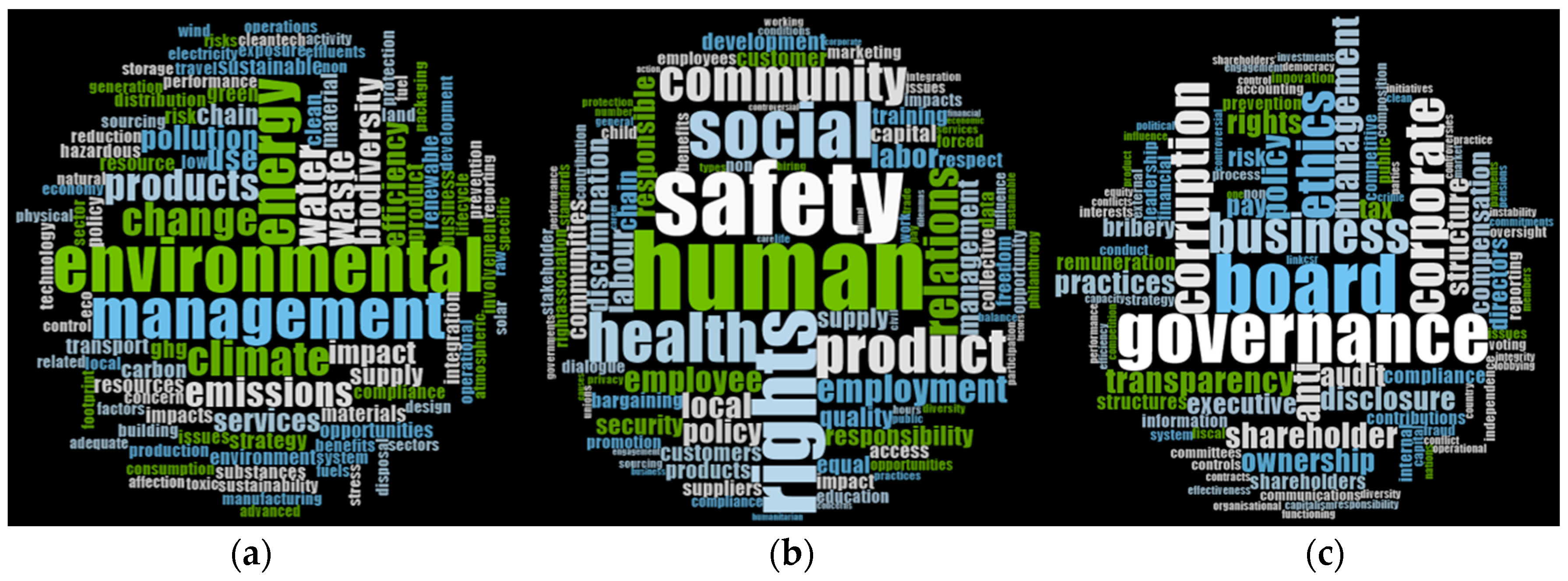

The E in ESG - Environmental criteria: includes the actions taken by corporates or governments to mitigate climate change through activities that reduce greenhouse gas emissions, along with waste management and energy efficiency. Given renewed regulations to combat global warming, cutting emissions and decarbonizing have become more important.

-

S - Social criteria: includes human rights, supply chain labor standards, any exposure to illegal child labor, and more mundane issues like workplace health and safety. A social score also rises if a company is well integrated with its local community and therefore has a ‘social license’ to operate with consent.

-

G – Governance: refers to a system of rules or principles that define the rights, obligations, and expectations of various stakeholders. A well-defined corporate governance framework can be used to balance or align stakeholder interests, as well as to support the company's long-term goals.

We are facing a number of global challenges: climate change, transitioning from a linear economy to a circular one, supporting diversity and balancing economic needs with societal needs. Various stakeholders for example investors, regulators, as well as consumers and employees are now increasingly demanding that companies must also concentrate on natural and social capital along with financial capital. Also, more investors are incorporating ESG elements into their investment decisions.

In recent days, ESG is broadly thought of as a reporting framework, however, initially it was a framework developed for investors to evaluate companies' sustainability related disclosures and now with demand for ESG related information is rising, the ESG framework has become synonymous with reporting.

The US Business Roundtable released a press release in August 2019 strongly affirming businesses’ commitment to a broad range of stakeholders. ESG-oriented investing has experienced a significant rise and worldwide sustainable investment now tops $30 trillion—up 68 percent since 2014 and tenfold since 2004.

Indicators and Significance of E, S and G –

Graphical representation of the underlying Indicators within (a) the environmental domain; (b) the social domain; (c) the governance domain (ESG Indicators as Organizational Performance Goals: Do Rating Agencies Encourage a Holistic Approach? – MDPI)

Paper published by Mckinsey, 2019 shows that a strong environmental, social, and governance (ESG) proposition links to value creation and helps the companies to attract B2B and B2C customers with more sustainable products, also attracts the right talent inside the company who are passionate towards sustainable development. It further helps the companies in cost reduction, to achieve strategic freedom and avoid the regulatory and legal interventions. Also, a strong ESG proposition helps in better and responsible allocation of capital for the long-term (e.g. More sustainable plant and equipment) that benefits in investment and asset optimization.

Conclusion –

Once your company has determined the relevant criteria for its ESG framework, next steps are to establish metrics, monitor and measure them on a regular basis and share the progress publicly, otherwise, companies will be accused of "greenwashing." And greenwashing is going to become harder to get away with, as many institutions are increasingly calling for companies to file CSR and Sustainability reports.

Investors have a number of tools or criterions to determine whether companies are greenwashing or thoroughly integrating ESG policies in their business activities. Companies that are committed to executing their ESG policies will inculcate this aspect in their core values, and they voluntarily disclose their ESG goals, and more importantly they will communicate the same to all stakeholders via the annual report/sustainability reports, internal corporate communications, etc.

-Suhas works as a client relationship executive and is a part of the sales department at Treeni.